34+ taxes mortgage interest deduction

However you may also have other possible itemized deductions. Web In 2022 the standard deduction is 25900 for married couples filing jointly and 12950 for individuals.

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Web How to claim the mortgage interest deduction.

. Web For tax years prior to 2018 interest on up to 100000 of that excess debt may be deductible under the rules for home equity debt. The mortgage interest deduction is an itemized deduction. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes.

Thats 5000 you can itemize as a deduction on your tax bill and you want to get credit for each and every dollar you spent. If your total property is rented out for the entire year you can deduct 100 of the mortgage interest paid on that property. Web How To Claim The Home Mortgage Interest Deduction On Your 2022 Tax Return.

It details how much you paid in. However if your property operates as a short-term rental you may only claim a portion of the interest paid on the home. In this example you divide the loan limit 750000 by the balance of your mortgage 1500000.

If you are single or married and filing jointly and youre. Many homeowners completely overlook this deduction Poulos says. 16 2017 these numbers increase to 1 million and 500000 respectively.

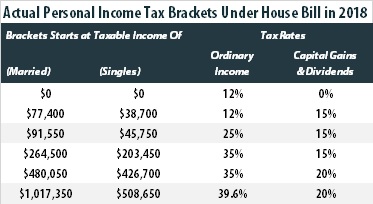

You can deduct mortgage interest paid on qualified home for loans up to 1 million or 500000 if married filing separately for loans taken out before 2018 or up to 750000 or 375000 if married filing separately for loans taken out in 2018 and beyond. Also known as the SALT deduction it allows taxpayers to deduct up to 10000 of any state and local property taxes plus either their state and local income taxes or sales taxes. However higher limitations 1 million 500000 if married filing separately apply if you are deducting mortgage interest from indebtedness incurred before December 16 2017.

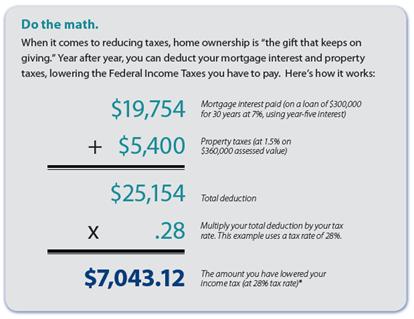

Web How to Claim the Mortgage Interest Deduction. Web A home mortgage interest deduction allows taxpayers who own their homes to reduce their taxable income by the amount of interest paid on the loan which is secured by their principal residence. If you choose the standard deduction you will not need to complete more forms and provide.

However for acquisition debt incurred. The taxpayer paid 9700 in mortgage interest for the previous year and only has 1500 of deductions that qualify to be itemized. Deduction for mortgage interest paid.

A single taxpayer in the same 24 tax bracket also wonders if itemizing taxes would result in a lower tax liability. The mortgage deduction makes home purchases more attractive but contributes to higher house prices. Your mortgage lender sends you a Form 1098 in January or early February.

Whereas in case of the general tax system you can deduct interest on the equity loan is. Interest paid on the mortgages of up to two homes with it being limited to your first. Look in your mailbox for Form 1098.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web Mortgage Interest Deduction Double-check in the mortgage interest section of your return that you did indicate that the interest is secured by a property that you own. It allows taxpayers to deduct interest paid up to 750000 375000 for married filing separately worth of principal the original amount borrowed on either their first or.

Web How to Claim the Home Mortgage Interest Deduction. Web While you plan for your taxes here are 34 Tips that can help you have a stress-free tax season. Get Your 1098 From Your Lender Or Mortgage Servicer.

Though the HMID is viewed as a policy that increases the incidence of homeownership research suggests the deduction does not increase homeownership rates. Web How much mortgage interest can be deducted from taxes. Web The deduction for mortgage interest is available to taxpayers who choose to itemize.

15 2017 can deduct interest on loans up to 1 million. Also you can deduct the points you pay to get the new loan over the life of the loan assuming all of the new loan balance qualifies as acquisition. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage debt on their primary or second home.

Web Most homeowners can deduct all of their mortgage interest. Web The mortgage interest deduction allows you to deduct a limited amount of mortgage interest from your taxable income lowering the amount of tax you owe. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up.

Homeowners with a mortgage that went into effect before Dec. Web Mortgage Interest Tax Deduction. Web Tax break 1.

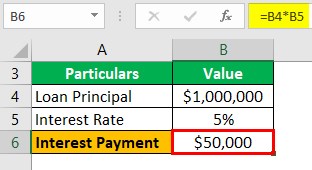

This gives you 05 which you multiply by the total. Lets say you bought a home in New York using a500000 loan with a 1 origination fee. Web If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent for a loan term of 30 years heres what you will get to write off as a tax deduction.

Web One point is equal to 1 of your loan amount. If you have a smaller mortgage or have almost paid off your mortgage the standard deduction could be bigger than your potential mortgage interest deduction. Web Deduction for state and local taxes paid.

The deduction is only available if you choose to itemize your deductions. Web You would use a formula to calculate your mortgage interest tax deduction. If this is answered no instead of yes then the mortgage interest is not deducted.

The standard deduction is 19400 for those filing as head of household. For debts incurred before Dec. Choose A Standard Deduction Or An Itemized Deduction.

The good news is that you may be able to deduct mortgage interest in the situations. Web Taxpayers making over 200000 will make up 34 percent of claims and take 60 percent of the benefits.

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

:max_bytes(150000):strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

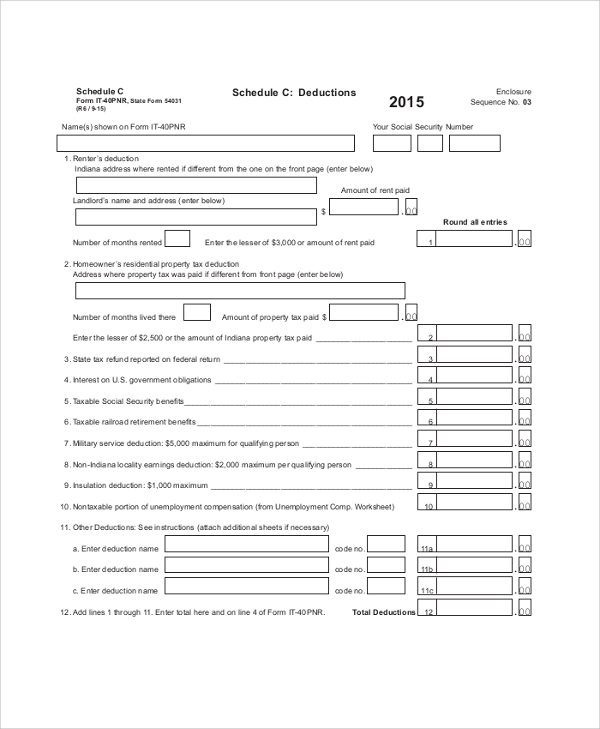

Free 8 Sample Schedule Forms In Pdf

Mortgage Interest Deduction Bankrate

Mortgage Interest Deduction A 2022 Guide Credible

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

Ex 99 1

:max_bytes(150000):strip_icc()/InterestDeductions-0c6d98dac2c64b9a93c07d8078ae5fdd.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Interest Deduction Rules Limits For 2023

Mortgage Interest Deduction Bankrate

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Coming Home To Tax Benefits Windermere Real Estate

Business Succession Planning And Exit Strategies For The Closely Held

Mortgage Interest Deduction How It Calculate Tax Savings

What Tax Breaks Do Homeowners Get In New York